Breaking down the critical steps of the sales cycle

Ryan Chen

Content Marketing Associate

This guide breaks down the critical steps in the sales cycle including prospecting, qualification, and closing, as well as challenges you’ll encounter.

Introduction

The sales cycle refers to the journey of a potential customer, from initial engagement to a closed-won deal. While every sales organization will customize some elements of the sales cycle to meet the unique needs of their business, most steps follow a similar pattern.

Each step of the sales cycle has its own set of challenges. For example, how can you attract potential customers during the prospecting stage? Or, how can you discern intent and other buying signals during the qualification stage? In this guide, we’ll walk through the various steps of the sales cycle and break down common challenges you might encounter. We’ll also share how you can boost sales productivity and empower your team to follow-up with leads rapidly by resolving disconnects throughout your revenue stack. Let’s get started.

Part 1: Sales prospecting

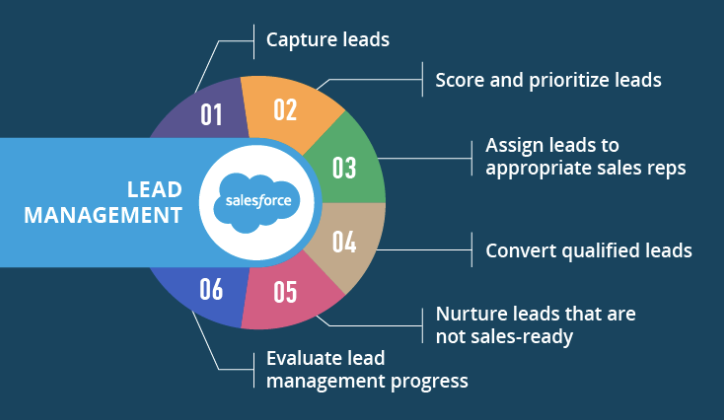

A typical lead management flow. Image courtesy Salesforce.

While you can source new business opportunities from any number of channels, the sales cycle most commonly begins with inbound efforts from your marketing team as well as from sales prospecting. The goal of sales prospecting is to find potential buyers (otherwise known as prospects) that are either interested in your product or highly likely to be, based on several parameters unique to your business. Identifying and engaging interested buyers is a cross-functional effort—your sales team will certainly do its part with personalized outreach activities, but your marketing team will also chip in with lead generation campaigns of their own.

Lead generation takes a transactional approach to identifying and fostering buyer interest. Lead generation involves your marketing team offering collateral, such as blog posts, e-books, emails, social media, webinars in exchange for prospects’ contact information. An interested visitor will, for example, download your e-book or sign up for a webinar by filling out a web form. These web forms typically capture basic information such as the buyer’s name, email address, phone number, and job title to send additional resources that may be of interest. Eventually, these resources might compel this buyer to request a demo or buy your product—but we’ll get to that later.

You’ve now created a lead, or someone who has expressed interest in your product, industry, or content by engaging with your marketing offerings. The business that a lead is affiliated with is called an account. Depending on how much information you capture on your forms, or how much they’re willing to share, you may end up missing crucial sales data such as contact or company details, for which your organization might use data enrichment solutions.

While prospecting and lead generation work hand in hand, a lead and a prospect are different concepts. A visitor becomes a lead by engaging with your marketing offers, so while they are interested in your content, they may not initially be very interested in buying your product. In contrast, your sales team will need to qualify a lead in order for it to become a prospect, meaning they’re a good match for your specifically defined buyer profile. So, while every prospect is a lead, that doesn’t mean all leads are prospects.

Part 2: Sales qualification

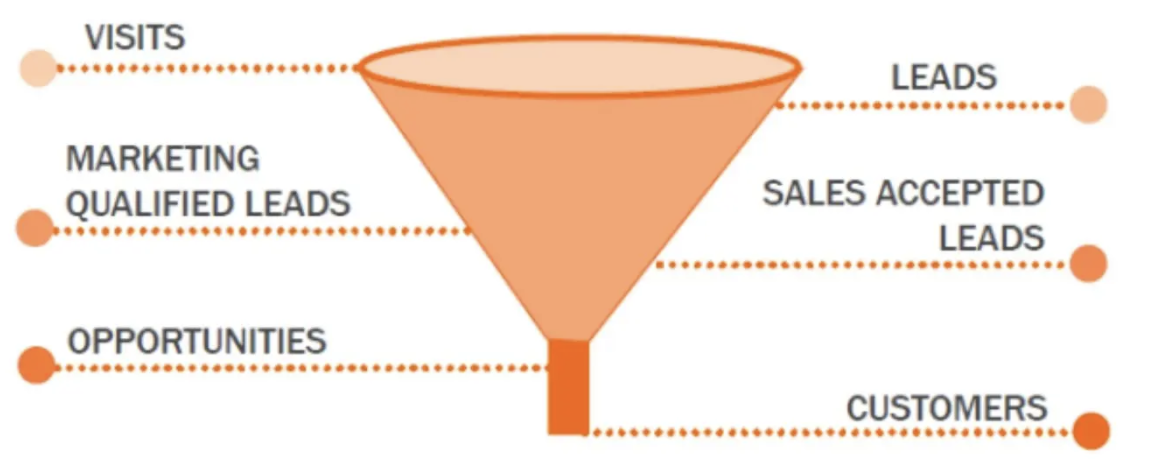

A typical sales funnel. Image courtesy of HubSpot.

Now that you’ve gone through the hard work of generating and capturing leads within your CRM, you might be wondering how you can engage them. After all, some of your leads may have no interest in your product, and others might not be in a position to buy at the moment. To isolate the leads that are actually interested in buying, your leads will need to go through qualification. Every company will have qualification criteria unique to its needs, but there are a few ironclad questions that can help you determine if a lead is a good fit:

How does your product solve this lead’s pain?

Sales representatives sit at the front line of your sales team, and one of their jobs is to diagnose a lead’s pain points through qualification. Getting a pulse on where your lead is hurting with qualitative research will help you better understand if your product can alleviate said pain. Some common pain points include:

Financial - A lead’s current product may be too expensive, and they are seeking a cost-effective alternative

Productivity - A lead is seeking a more-efficient solution that saves their team time and resources

Support - A lead currently lacks adequate support at some juncture along their journey, whether it be during implementation, adoption, maintenance, or scaling to meet changing needs

Why does this lead need your product?

Just because a lead feels pain doesn’t necessarily mean they need your product. A customer can encounter many different problems with their processes and still not be interested in finding a better solution. Or rather, they may not feel that the issue is urgent enough to address by investing in another solution.

Customer attention is scarce. Purchasing decisions obviously require a budget. But some buyers also need approval from stakeholders across their business. Meanwhile, competitors and alternative solutions in your space are vying for the same attention. This can lead to buyer inertia—a buyer doing nothing at all, even in the face of very painful business problems. After all, 62% of salespeople say that buyers who do not want to change are a major obstacle for closing deals. Your sales team needs to not only uncover a customer’s pain but also justify why your product is worth making a change.

Does this lead fit your ideal customer profile?

Your ideal customer profile (ICP) is a common set of criteria used by revenue organizations to determine which customers are most likely to be interested in your product, and therefore are ideal buyers. ICP varies from company to company and is often defined by characteristics such as budget, company size, industry, geography, or persona. Your ICP will help you narrow down which leads warrant further outreach and which leads do not. Besides junk leads, you might also have to disqualify leads that express interest but don’t fit your ICP.

Disqualification is an essential part of the sales process. Instead of scattering your bandwidth across several mismatched leads that aren’t in-market, focus your efforts only on the leads that align most closely with your ICP.

What is lead scoring?

With lead scoring, you can efficiently qualify and disqualify leads by assigning values according to various attributes. Attributes are rules that are prioritized against one another to calculate a single score that reflects a lead’s fit. These attributes might include historical lead data, conversion patterns, demographic information, firmographic information, lead source, and more. Using a predictive model specific to your company’s guidelines, you can prioritize the hottest leads first on your queue and streamline qualification.

Actions that might impact your lead score. Image courtesy Chili Piper.

Part 3: MQL vs SQL - what’s the difference?

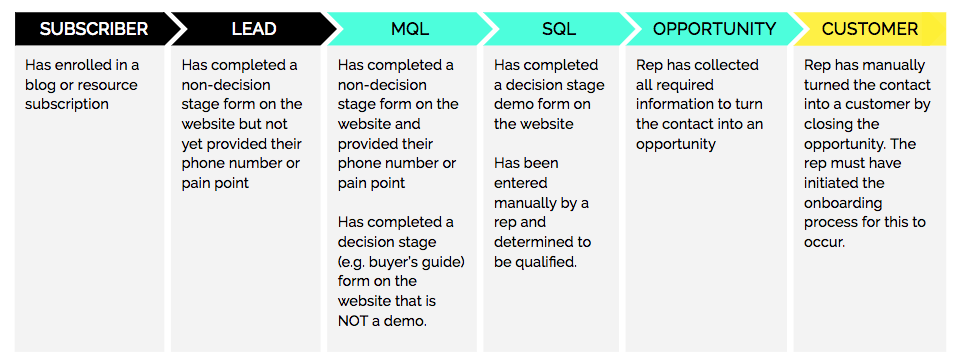

The difference between an MQL and SQL. Image courtesy of SmartBug.

After you’ve determined that a lead is a strong fit for your business, it becomes what we call a marketing-qualified lead (MQL). A marketing-qualified lead is a lead that has met or exceeded your team’s scoring threshold. At the very least, you’ve determined that an MQL is curious about your product and has the potential to buy.

But at what point does curiosity become actual intent? As mentioned above, your sales team has limited time and resources, so you need to hand over leads that have the hottest, most legitimate willingness to buy. The truth is, even after such a stringent qualification process, only 13% MQLs advance to sales as opportunities. In other words, these leads never become sales qualified.

In contrast, a sales-qualified lead (SQL) signifies that a lead has more than just potential interest; they’ve spoken directly to sales and have been confirmed as a strong fit. The MQL-to-SQL handoff is a critical inflection point in the sales cycle—how do you know which MQLs should become SQLs? Consider:

BANT framework

BANT stands for budget, authority, need, and timeframe. When your sales representatives make that first call to vet potential SQLs, the BANT methodology will help them personalize outreach, pitch your product, and handle objections.

Lead behavior

A lead’s behavior can give you contextual signals about their willingness to buy. Depending on how your lead engages with your content, we can make assumptions about where they might be in your sales cycle. For example:

Is this lead a first-time visitor on your website or a repeat visitor?

What type of marketing content is this lead engaging with? Is it a top-of-the-funnel blog post or a pricing one-pager?

Has this lead gone cold and has stopped engaging with your outreach?

Sales-marketing alignment

Sales-marketing (or “smarketing”) alignment is all about getting your sales and marketing team on the same page to seamlessly execute campaigns, manage leads, and ensure an outstanding customer experience. When you have agreed-upon MQL vs. SQL definitions, tools, processes, and goals, your projects and campaigns can work in tandem—a seamless, symbiotic relationship.

For example, your sales and marketing teams can create a mutual definition of an ICP with legitimate buying interest. Knowing a lead’s sales data is not enough; what combination of demographics and firmographics data will yield a high and relevant lead score? And what are your revenue team’s common goals? Are you looking for more pipeline or are considering a more granular account-based approach? Are you just starting off with your customer acquisition strategy, or are you trying to move upmarket to target enterprise companies? When both sales and marketing know exactly what constitutes a high-quality lead, you’re less likely to hit snags at the eventual point of hand-off.

Part 4: Closed-won or closed-lost

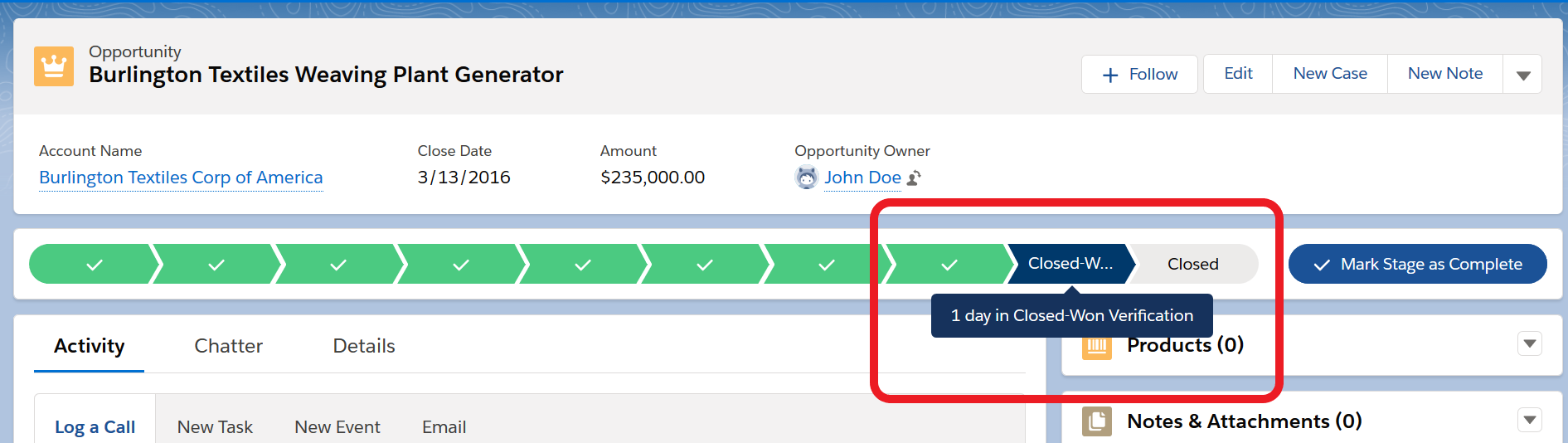

A closed-won deal. Image courtesy of Nextian.

When your account executives accept an SQL, it’s converted into a sales-qualified opportunity (SQO). A SQO has been thoroughly qualified, entered your sales pipeline, and has a high chance at buying your product. Now, your sales team can invest their full resources into pitching the account, knowing that they are a great fit.

Let’s fast forward to the end of the sales cycle, where one of two things can happen—your sales team can mark a deal as closed-won or closed-lost. If your sales team loses out to a competitor, or if the customer reevaluates their needs and decides your product isn’t a good fit, you’ll need to close out the opportunity in your CRM. But this shouldn’t mark the end of your journey with this lead. A closed-lost opportunity is also a chance for your sales team to understand what went wrong and apply those learnings to future deals. Here are a few common reasons for lost deals:

Price - Your product is too expensive. Consider who you’re selling to and what market they are in. For example, if you are selling to SMB companies at enterprise prices, you may have to revisit your pricing strategy.

Timing - There are other priorities on this customer’s list that supersede buying and adopting your product.

Product did not meet requirements - Your product lacks the functionality your customer needs or is too complicated to adopt.

No budget - The customer does not have budget at the moment to commit to a purchase.

Competition - The customer has chosen to commit to a competitor.

Doing nothing - The customer has elected to do nothing rather than purchasing your product.

Not ready to buy - If, after an entire buying cycle, you find that the customer is not ready to buy, consider redefining your qualification process.

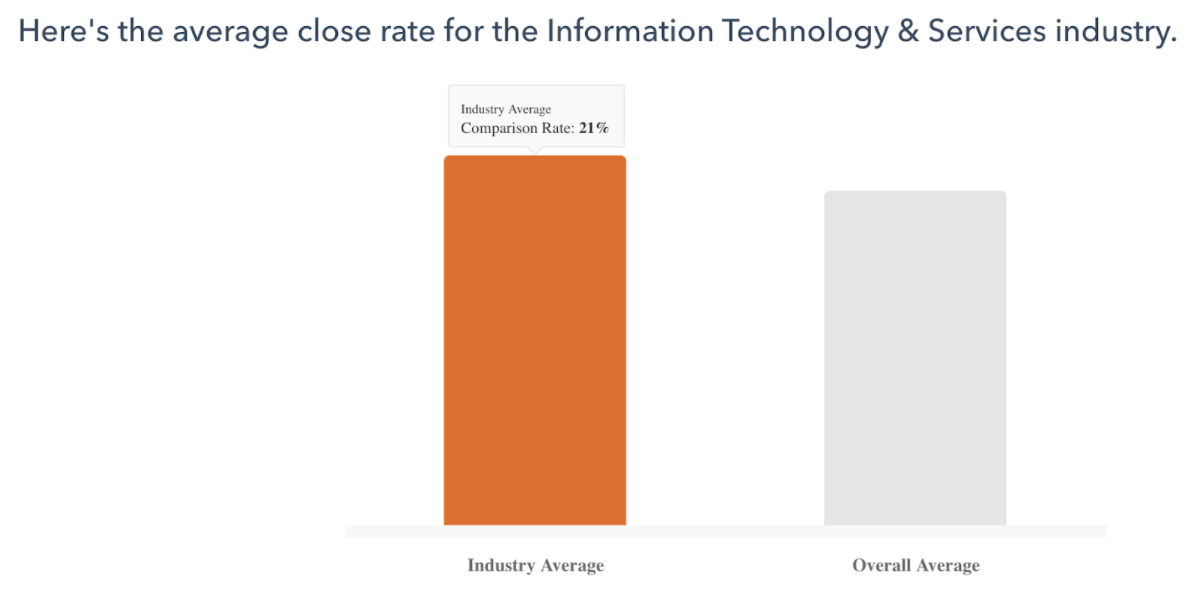

If your sales team wins a deal, that means you’ve received the coveted ‘yes’ from your customer, received a signed contract, and are ready to start an engagement. Across the technology and services industry, the average close rate is only about 21%.

Average close rate for the technology and services industry. Image courtesy of HubSpot.

Here are a few key sales metrics that are worth tracking after your team starts to close deals:

Average selling price (ASP) - The average amount a customer pays for your product. ASP helps your team set forecast revenue and identify a pricing strategy aligned with current demand for your product.

Average deal size (ADS) - ADS is calculated by dividing total revenue by total closed-won opportunities. Deal sizes can differ depending on discounts, customized plans, upsells, and cross-sells.

Average time to close - The average amount of time it takes to close a deal. The average time varies by average deal size, but for SaaS companies selling $20K to $50K deals, it takes around two to three months to close a deal.

Win rate - The percentage of SQOs that are closed-won in your CRM. You can improve win rates by enabling your account executives with not just product knowledge but also rapport building, managing objections, and negotiation skills.

Leading indicators - Leading indicators are the inputs that contribute to a closed-won deal. These might include pipeline coverage, sales rep quota, number of sales meetings, rep onboarding time, expected capacity of reps to opportunities, and more. Sales operations professionals seek to optimize leading indicators to improve the effectiveness (quality of selling) and productivity (speed of selling) of your sales team.

Lagging indicators - Lagging indicators are the outputs that reflect the outcomes of a closed-won deal. These might include annual contract value, annual recurring revenue, customer acquisition cost, win-loss ratio, customer churn, customer retention, and more. Sales operations professionals use lagging indicators for reporting and forecasting. Lagging indicators are also tied to leading indicators; one informs the other, and you can typically anticipate the outcome of lagging indicators based on the performance of your leading indicators.

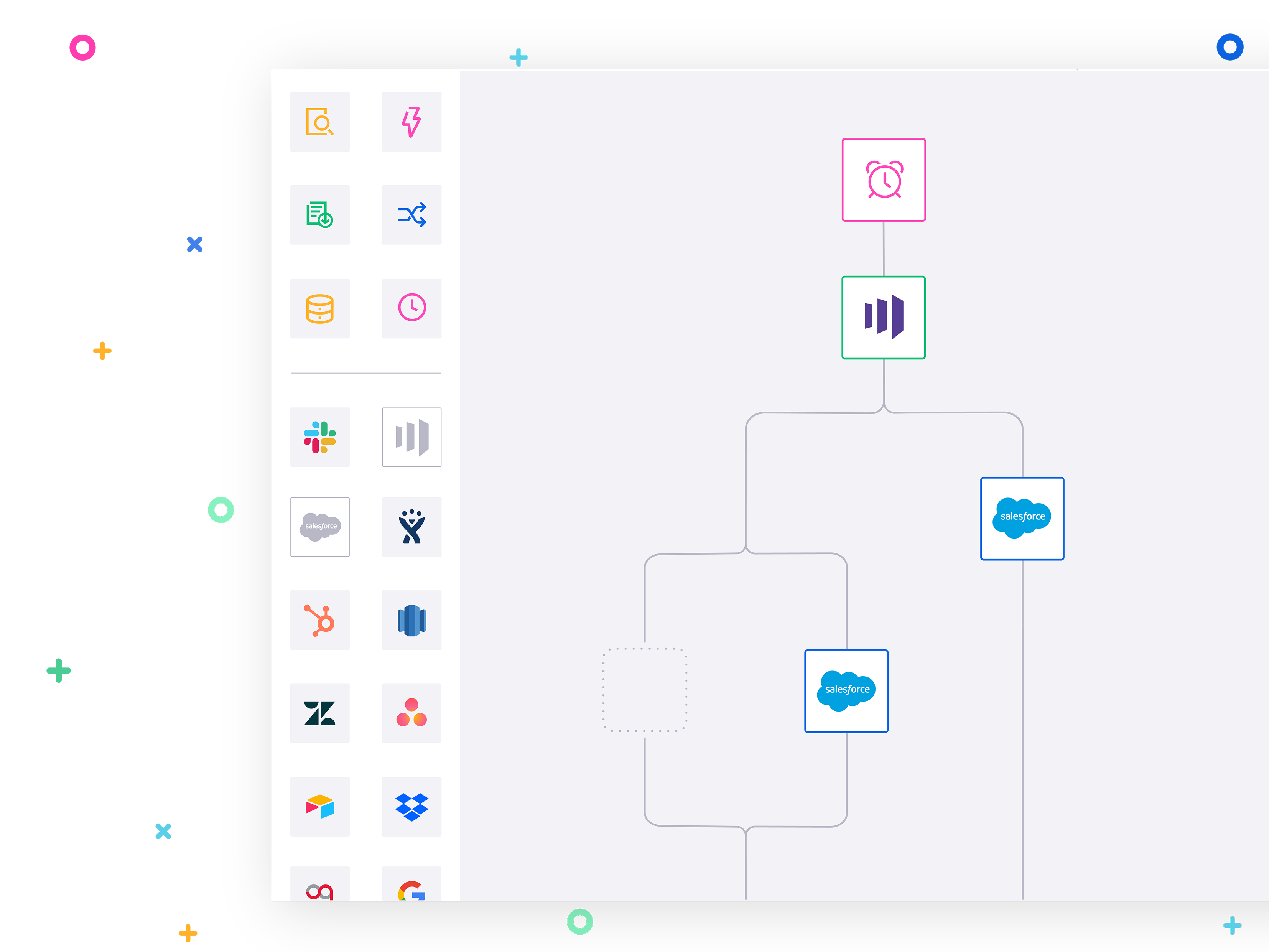

A better way to manage your sales cycle: General Automation Platforms

A General Automation Platform (GAP)

There are reasons why sales professionals spend just 34% of their time actually selling. In every stage of the sales cycle, your team will encounter manual work that impedes sales productivity, slows lead follow-up times, and ultimately prevents you from delivering a standout customer experience. So how can you eliminate the administrative burden from your sales team and win more deals?

High-performing sales teams use a General Automation Platform (GAP) to close the gaps in their sales processes and streamline the sales cycle. GAPs are low-code platforms designed to help any business user stand up custom integrations between their favorite tools. And beyond integrations, sales professionals use GAPs to orchestrate powerful, multi-step automated workflows that satisfy any use case. Here are a few ways sales professionals are using GAPs to take full control of their sales cycle:

Lead enrichment - Speed is of the essence - those that respond to a lead within an hour of first contact are 60 times more likely to qualify a lead than those who waited 24 hours. Your reps need clean sales data that’s fully enriched so they can rapidly reach out to promising leads. Commonly, sales organizations use data enrichment services such as Clearbit or Datafox to fill in the missing fields and get full context on their sales data. Using a GAP, you can easily drag-and-drop together integrations that flow your enriched sales data into your CRM, marketing automation platform, chat bot, and any other application.

Data hygiene - Contact databases decay by 20-25% year over year because your sales data might be incorrect, outdated, duplicate, improperly formatted, missing key fields, invalid, or inconsistent. Good data hygiene will ensure that you’re not spending your sales team’s resources contacting bad leads. Using a GAP, you can dynamically cleanse duplicate CRM records, bulk update and reconcile various record types, and more.

Quote-to-cash - Seamlessly convert closed-won deals into revenue by automating the entire quote-to-cash process. Research shows that organizations with a unified quote-to-cash process see a 7% increase in sales revenue. You can use a GAP to rapidly create quotes, streamline contract approvals, provision accounts, increase upsell opportunities, and more.

If you’d like to learn more about a General Automation Platform, sign up for a weekly group demo. For more reading on how a GAP can help you streamline the sales cycle, check out these resources: