3 ways to plug revenue leakages with O2C automation

Revenue leakage remains a pressing concern for nearly half of all companies. The triad of efficiency, cost minimization, and meticulous tracking of every incoming and outgoing dollar defines the battle strategy for finance and operations teams in 2023 and beyond. This might sound like a tall order, but there’s one strategic move that can set these teams on the path to financial success: a critical evaluation and subsequent transformation of their order-to-cash (O2C) cycle.

The O2C cycle forms the financial backbone of any business, stringing together the processes from the moment a customer places an order until the payment is secured. Traditionally, O2C processes are laden with manual operations and suffer from inefficiencies such as human errors, redundancies, and a lack of transparency.

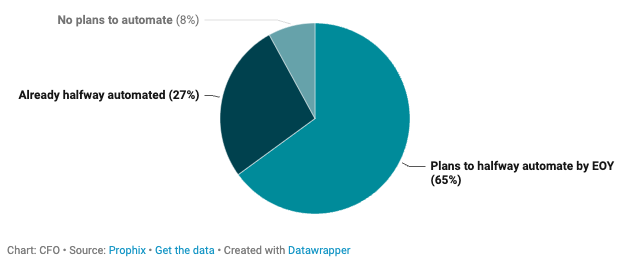

Today’s CFOs, finance, and operations leaders are leaning heavily into innovative automation technologies to transform these disjointed processes into sleek and efficient workflows. Recent data from Prophix’s 2023 Finance Leaders Survey of 700 finance executives found that 92% of finance leaders are already or hoping to automate half of their practices by the end of this year.

Leveraging automation to improve financial processes is a top priority for finance leaders in 2023.

With a low-code automation platform, finance and operations teams can reinvent their order-to-cash cycle, eliminating manual tasks, accelerating cash flow, and gaining insight into financial performance. Here are three ways a low-code order-to-cash automation solution can plug revenue leakages and transform the O2C cycle.

1. Reduce manual errors and mismanagement

From incorrect data entry to fraudulent activities, even a single mistake within the O2C cycle can punch holes in the revenue bucket and cause leakages. Lack of integrations between critical sales and finance systems like Salesforce and NetSuite leaves finance teams manually moving data between applications, increasing the potential for human error. And your finance teams are spending a lot of time on manual tasks. 72% of teams spend around 10 hours per week on tasks that can easily be automated, such as invoice processing, PO (purchase-order) matching, and payment reconciliation.

Low-code automation platforms eliminate data entry errors and departmental silos by seamlessly integrating sales and finance applications. To further ensure data accuracy, finance teams can deploy ready-built, pre-packaged O2C workflows so they can automate key O2C steps right out of the box. For instance, the template “Sync Closed Won Salesforce Opportunities to NetSuite as Sales Orders” does exactly what its name suggests and lets teams auto-sync Salesforce opportunities to NetSuite sales orders, effectively sweeping away hours of labor-intensive manual work in only seconds.

2. Improve efficiency and velocity of cash flow

Lags in the billing cycle can serve as a heavy anchor, dragging down your cash flow while also souring customer satisfaction. In fact, 77% of customers have had poor billing experiences, and two-thirds would consider ditching companies with inefficient billing practices.

Automating the O2C process can significantly reduce time lags between order processing, billing, and payment collection, leading to improved customer satisfaction and accelerated cash flow. Leading companies like Mixpanel and Udemy leverage low-code automation to transform critical finance processes, allowing them to prioritize mission-critical financial projects that increase profitability. For instance, Mixpanel used the Tray platform to transform its O2C processes, reducing the manual labor required to complete a sales order by 25%.

3. Enhance visibility and control

With the ubiquity of online purchasing, buyers now expect every purchase process to follow the same level of transparency such as order tracking, step-by-step updates, and frequent communication. However, broken O2C processes limit visibility for both the buyer and the seller, resulting in errors and potentially lost revenue.

By automating processes such as order updates, notifications about potential account issues, and payment reminders, finance teams can achieve a more transparent O2C process. This lets them proactively identify potential revenue leakage areas before they escalate. Additionally, the enhanced error handling capabilities that automation platforms deliver allow for real-time diagnosis and resolution of issues.

Tray.io’s CEO, Rich Waldron, points out that this kind of visibility and control can establish steady cash flows, an essential factor in a scarce capital environment. "With Tray.io’s AI-augmented low-code platform, extensive library of connectors, and the governance capabilities IT demands, finance teams who are intimately familiar with their O2C processes now have the flexibility, speed, and control they need to solve their business issues and establish steady cash flows."

Eliminate manual work and automate your way to cash faster

O2C automation offers a robust approach to plugging revenue leakages. By reducing manual errors, improving efficiency, and enhancing visibility and control, companies can safeguard and augment their revenue while delivering superior service to their customers.

To learn more about Tray.io’s Order-to-Cash solution, visit this page.